Writer: Burak Saykal

1. Indroduction

The textile sector, in addition to being one of the oldest industries in the world, is a significant economic activity encompassing a wide range of sub-sectors, primarily divided into two groups: textiles and ready-made clothing. In the early stages of history, traditional production processes gave way to mass production with the Industrial Revolution, playing a critical role in the industrialization of countries. Today, with the support of technology, the textile sector has achieved the ability to produce products with different properties and structures in a short time, becoming a significant sector for the economies of many countries. The textile sector’s primary raw materials include cotton, wool fiber, artificial and synthetic fibers, jute, and hemp. Yarn and finished fabric products are considered textiles, while those from fabric to finished garments are considered within the ready-made clothing sector. When considered together, both sectors represent a long production chain.

The textile and apparel sector, due to its size, is critical to a country’s macroeconomic variables, particularly growth, development, and employment. In this context, textiles, which were previously a driving force in the growth and development of countries that completed the industrial revolution, expanded in terms of usage and trade due to the rapid integration of the global economy in the 1980s. As a result, it is now among the most globalized industries (Aydoğdu, 2012). Consequently, it has become a significant source of income not only for developed countries but also for developing ones (Ekti, 2013).

Due to its structure, the textile and garment sector has been managed separately from the General Agreement on Tariffs and Trade (GATT) laws for many years. In this context, with the establishment of the World Trade Organization in 1995, the “Agreement on Textiles and Clothing Agreement on Textiles and Clothing-ATC” was adopted and entered into force (Şahbudak and Şahin, 2016:127).

In general terms, it is stated that the share of the textile sector in world exports has decreased significantly over the years (Bayraktar and Sezer, 2022). Among the main reasons for this decline, technological progress and the prominence of high value-added products (e.g. automotive, pharmaceuticals, electronics, etc.) in global trade are cited. In addition, the increase in production volumes of developing countries, the restructuring of value chains on a global scale, and the acceleration of digitalization in production are important factors in this change. Therefore, this change does not only explain the contraction in the textile sector, but also reflects the structural change in world trade.

Today, the textile sector plays a decisive role in the macroeconomic structure in countries like Turkey, where production capacity is strong and labor-intensive production is intensive, since it has the potential to directly affect employment, exports and industrial production volume. Textile, which has an important place in Turkey’s economy in the historical process, has reached wider markets and its foreign competitiveness has increased with the acceleration of industrialization and integration with the world economy in the modern period. However, with the recent economic/non-economic reasons; supply chain problems have started to be encountered frequently, as well as cost increases in energy and exchange rates have created significant risks for the sustainability of the sector.

In this study, the textile sector is analyzed in a global and Turkey-specific perspective, and the historical process, current structure, economic dynamics and risk factors that the sector faces/may face are discussed in detail. In addition, it is aimed to provide a road map for the future by developing strategies and recommendations for the sector.

2. Historical Journey of Textile Sector in Türkiye

The origins of cotton weaving are traced back to Central Asia and China. Turks began to grasp weaving practices during their time in Central Asia. Over time, the westward migration of Turkic tribes from Central Asia enabled the spread of weaving activities from east to west (Şentürk et al., 1976, 54). With the settlement of Turkic tribes in the Aegean and Mediterranean regions, particularly from the 13th century onwards, the production and consumption of textiles such as rugs and carpets increased. During the Ottoman expansion, guilds implemented market regulation by controlling prices and products. The organized supply of raw materials by the guilds ensured that the production process was managed smoothly and systematically, without disruption. In this context, it can be concluded that production and market conditions had a direct impact on the development of cotton textile production.

Production by both locals and trade caravans helped Anatolia, located on the Silk Road, become a significant market for cotton textiles. By the 16th century, Denizli and Tokat had become major production centers for textiles, Bursa for silk products, and Ankara for pure wool fabrics (Aras, 2006). The textile sector, which was a significant source of income for the Ottoman Empire, appears to have weakened its external competitiveness. Among the factors contributing to this decline in external competitiveness were the completion of the Industrial Revolution in Europe and the introduction of heavy industrial machinery and equipment technology in the textile sector (Güleryüz, 2011).

In the Republican period, the state gave importance to the establishment of spinning, weaving and cotton enterprises as a result of policies to encourage and increase domestic production. In this context, Sümerbank factory was established in Kayseri in 1933 and the foundations of the new structure of the textile sector were laid in accordance with the modern age (Erden, 2006).

The development of the Turkish textile industry accelerated with the First Five-Year Development Plan, implemented between 1931 and 1934. During this period, incentives were increased, particularly for the training of qualified individuals and increased production (Özgür, 2006). The textile sector was adopted as one of the fundamental branches of industrialization (Bayraktar and Sezer, 2022). In this context, protectionist state policies were adopted, and investments and the production channels of development administrations were emphasized (Owen and Pamuk, 1999). In the 1950s, while the state’s share of production decreased, the private sector’s share in investments began to increase. The private sector’s share, which was 28% in the early 1950s, rose to 62% in the early 1960s and 90% in the early 1990s. This ratio has now reached 100% (Özyazgan, 2012).

It symbolizes a transformation process that began in the early 1980s, when the Turkish economy began to open up to the outside world and liberalization policies were implemented. During this period, the goal was to limit the influence of the public sector on the economy, encourage private sector activities, and prioritize exports as the engine of sustainable economic growth (Beriş, 2008). Despite European Union quotas, Turkish textiles became one of Europe’s largest importers thanks to its favorable labor costs, easy access to raw materials, and flexible production structure. Its geographical location, low transportation costs, and short delivery times contributed to its competitive edge. Thus, the sector achieved significant progress (Arslan, 2008).

3. General Structure of the Sector

Historically, the textile sector, which played a significant role in accelerating economic growth in pioneering countries of the industrial revolution such as the UK, France, the US, and Japan, increasingly shifted its production and export activities to developing countries in the 1970s under the influence of outsourcing policies (Demir and Önder, 2023). An example of this is the shifting of Japanese companies to other Asian countries, South Korea and Taiwan, where they could meet lower costs due to rising production costs and employment cuts in Japan. This, coupled with low costs and cheap labor, led to increased production and employment, which positively impacted other Asian countries and contributed to the industrialization of these countries. In this context, it can be argued that the textile sector is shifting from developed to developing countries, the primary reason for this being the impact of rising production costs and shifts in employment dynamics (Aydoğdu, 2012).

3.1. A General Overview of the Textile Sector in Türkiye

In Turkey, which is among the developing countries, the textile sector plays a decisive role in the Turkish economy due to its share in the Gross Domestic Product (GDP), its leading role in determining employment capacity, its high level of export potential and its multiplier effect on other sub-sectors (ITKIB, 2013).

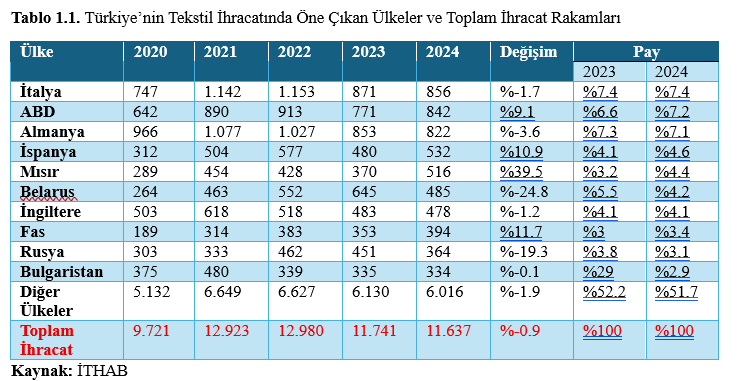

Turkey’s textile sector’s overall exports are to the US and EU countries. Following Turkey’s membership in the Customs Union in 1996, quota-free exports to the EU region began, and exports have accelerated since then. According to International Trade Organization (WTO) data, Turkey ranks 5th in global textile exports. Turkey’s strong position in the textile sector is driven by its broad product quality and range, its geographical proximity to European, African, and Middle Eastern countries, and its logistical advantages. This facilitates a flexible supply chain, enabling both small and large-scale companies to quickly supply demanded products. Turkey’s advantageous position and extensive production capacity positively differentiate the Turkish textile sector from other countries in the global economy. However, recent local and global developments have negatively affected the Turkish economy and led to fluctuations in macroeconomic variables. [Some developments in this period: The Gezi Park protests on 27.05.2013, the coup attempt on 15.07.2016, the system change referendum on 16.04.2017, the Pastor Brunson incident on 12.11.2018, the Covid-19 pandemic on 11.03.2020, the start of the Russia-Ukraine war on 22.02.2022 and the Hatay and Kahramanmaraş earthquakes on 06.02.2023. In addition to these developments, 3.65 million people are living in Turkey under temporary protection following the war in Syria that began in early 2010.] These cyclical developments have led to disruptions especially in exports, production capacity and supply chains. Based on this information, Turkey’s share of global textile and raw material sector exports over the years is shown in Figure 1.1.

An examination of the figure reveals that Turkey’s share of global textile and raw material exports averages 3%. Following the decline seen during the Covid-19 pandemic, a rapid recovery trend is observed, maintaining this trend in subsequent years. Overall, Turkey’s textile sector’s share of global exports was 31% in 1995, reaching 3.3% by 2024 (WTO 2025).

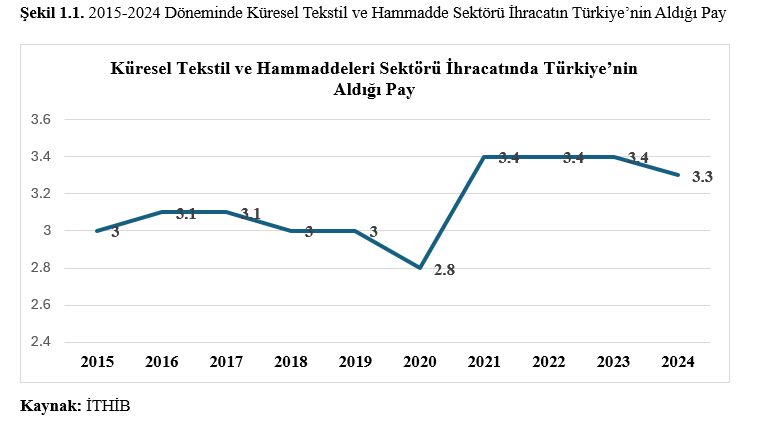

During this period, EU countries remained the largest export destinations, followed by African countries. Although EU countries are the largest exporters of the Turkish textile sector, the prediction that the economic stagnation in the EU region will continue has created expectations that the textile sector’s recovery will take longer (Demir and Önder 2023). Meanwhile, to prevent the negative impact of the February 6 earthquake on the production process that accelerated again after the Covid-19 pandemic, the United Nations Development Programme (UNDP) announced various aid packages for textile companies, particularly in the earthquake-affected regions (Euromonitor International, 2019). Based on this information, Turkey’s textile export destinations are shown in Table 1.1.

An examination of Table 1.1 reveals that textile exports are generally increasing, despite fluctuations. Furthermore, Turkey’s textile exports are largely directed to EU countries, with Italy accounting for the largest share. The US ranks second, and it’s noteworthy that exports to Egypt have also increased in recent years.

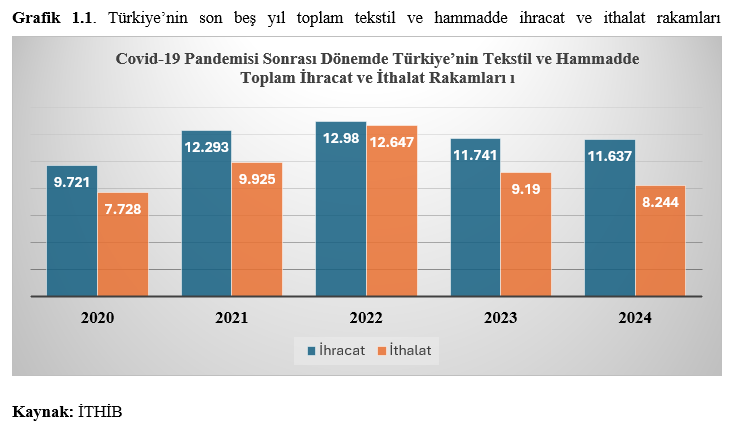

For a more accurate analysis of total foreign trade, import and export data should be evaluated together. For this purpose, Turkey’s total textile and raw material export and import figures for the last five years are shown in Chart 1.1.

An analysis of Chart 1.1 reveals a rapid increase in Turkey’s textile and raw material export and import figures, particularly following the Covid-19 pandemic. The fact that exports exceeded imports in 2020, in particular, demonstrates continued domestic demand and production. This process may explain why items like medical textiles contributed to the increase in exports. Both items appear to have reached their highest levels in 2022. However, the fact that imports are approaching exports as of this year reveals the sector’s external dependence on raw material supplies. The decline in exports and imports observed in 2023 and 2024 reflects the impact on the sector of factors such as the global economic slowdown, rising costs, and contracting demand.

3.1.1. Production Capacity

Effective and efficient use of production capacity is crucial for reducing production costs and increasing production, domestic and international competitiveness, and profitability. Therefore, the capacity utilization rate must be effectively determined in light of available data. In this context, the manufacturing capacity utilization rates for textile products in Turkey between 2010 and 2024 are shown in Figure 1.1.

An examination of Figure 1.1 reveals that the capacity utilization rate in the textile sector remained relatively stable between 2010 and 2024. During this period, it can be concluded that domestic demand, exports, and global competition played a supportive role, and that efforts were made to utilize production effectively. However, factors such as decreased production volume, reduced demand, and supply chain disruptions caused by the Covid-19 pandemic in 2020 led to a significant decrease in the capacity utilization rate compared to the previous year (ICAC, World Textile Fiber Demand 2024). While a rapid recovery was observed in 2021, the capacity utilization rate fluctuated in subsequent years. This demonstrates that the sector failed to achieve sustained production momentum in the post-pandemic period and faces structural challenges.

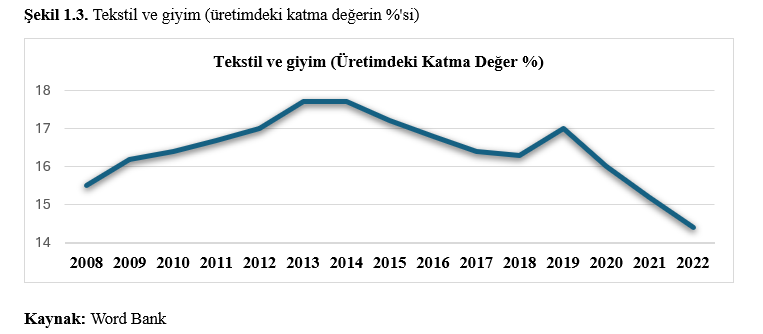

The change in the value added indicator, which is important in demonstrating the importance of the textile sector within the economic structure in Turkey and its transformation over time, between 2008 and 2022 is shown in Figure 1.3.

An examination of Figure 1.3 reveals that the value-added share of the textile sector in Turkey increased continuously from 2008 to 2014. However, it appears to have entered a downward trend after this period. The main reasons for this rapid decline can be attributed to sudden shocks in exchange rates, increases in raw material costs, and global competitive pressures. Disruptions in the supply chain and the excessive increases in energy and labor costs, particularly following the Covid-19 pandemic in 2020, led to a low value-added structure for the textile sector, and it began to lose its competitiveness against other industrial sectors (ICAC, World Textile Fiber Demand 2024). Consequently, capacity utilization rates vary from year to year depending on the economic conjuncture, but they generally increase.

3.1.2. Employment Level

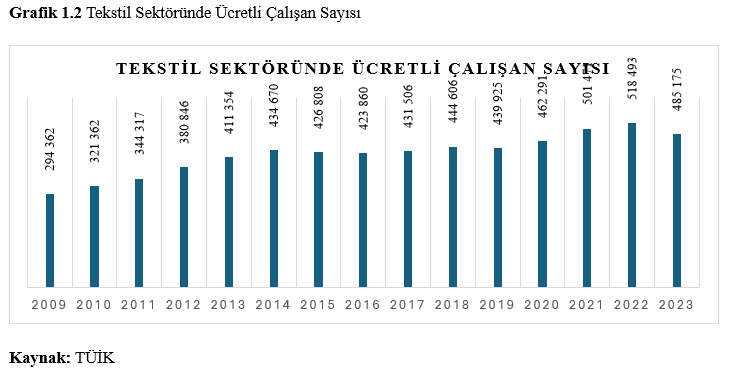

The textile sector, which holds a significant share in the Turkish economy, plays a critical role in employment due to its labor-intensive nature. This influence can determine production capacity and influence output levels. Changes in employment in the textile sector in Turkey between 2009 and 2023 are shown in Chart 1.2.

An examination of Chart 1.2 shows that employment in the textile sector increased steadily until 2014. Furthermore, employment remained stable between 2014 and 2020. Although employment peaked in 2021 and 2022, a decline is expected in 2023.

3.1.3. Main Export and Import Items in Turkey Based on Sub-Product Groups

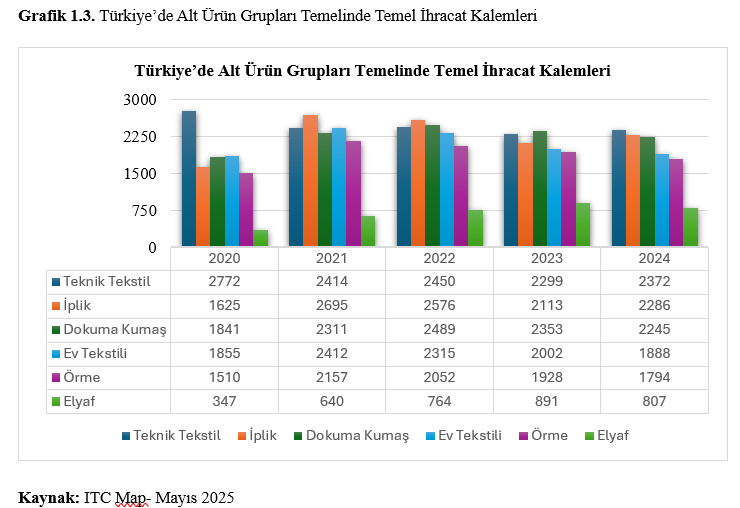

The textile sector accounts for a significant portion of export revenue in the Turkish economy. Considering its production capacity and product diversity, the sector is highly competitive in the global economy. Chart 1.3 shows the subgroups of products with the highest export volumes in the textile sector between 2020 and 2025.

An analysis of Chart 1.3 reveals that the technical textiles group’s export data is generally similar to global textile industry exports. Furthermore, technical textiles increased by 3.1% in 2024, reaching $2.400 billion and becoming the sub-category generating the highest export revenue in the sector. Turkey’s yarn exports increased by 8.2% in 2024, reaching approximately $2.4 billion, while exports of other sub-categories decreased compared to previous years.

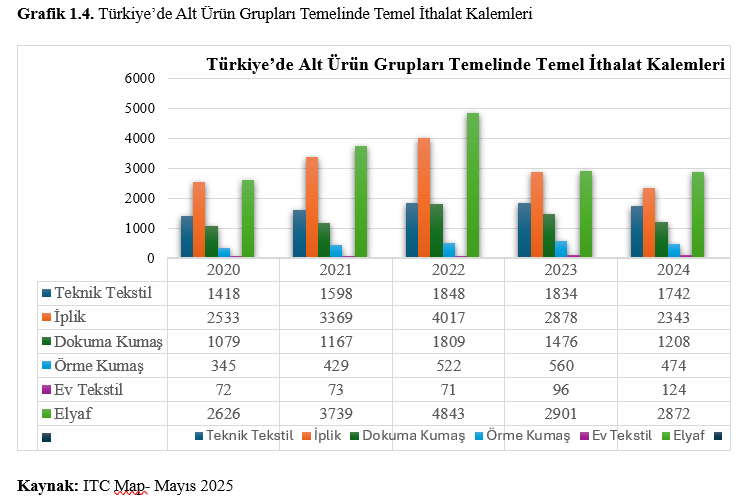

Due to Turkey’s import-substitution production model, it must import the raw materials, machinery, and equipment necessary for the production of a final product from foreign markets (Saygılı et al. 2010). To ensure continuity in the textile sector and to obtain a final product, some raw materials must be procured from foreign markets because their production is insufficient on a domestic scale. In this context, Turkey’s textile product import values, by subgroup, for the period 2020-2024 are shown in Chart 1.4

An analysis of Chart 1.4 shows that Turkey imported fiber by sub-product group during the period under review. Fiber was followed by yarn and technical textiles. Overall, there appears to be a decrease in imports of sub-product groups after 2022.

4. A General Overview of the Global Textile Industry

The recent volatility in the global economy has negatively impacted the textile sector. Furthermore, rising inflation rates and the resulting relative increase in interest rates in developing countries have led to a decline in aggregate demand. This decline in aggregate demand has also led to a decline in export revenues worldwide, particularly in the US and EU countries.

Commodity prices increased during the period that began with the Covid-19 pandemic, and this increase continued with the return of aggregate demand during the economic expansion phase. This increase in aggregate demand also impacted supply chain structures. In addition to this effect, global crises led to further price increases. Sudden fluctuations in energy prices and exchange rates, in particular, negatively impacted the textile industry. This negative impact, in turn, directly and indirectly led to increased production costs (Euromonitor International, 2023).

Disruptions in supply chains during the Covid-19 pandemic extended turnaround times. The increased need for logistics due to the increase in online shopping during this period forced textile industry operations to produce closer to the consumer (ICAC, World Textile Fiber Demand 2024). Brands with the capacity for large-scale production in the sector generally aimed to relocate their businesses to the Asia Pacific region due to lower production costs. During this period, China continued its growth trend due to its cheap labor and low production costs (Euromonitor International, 2023).

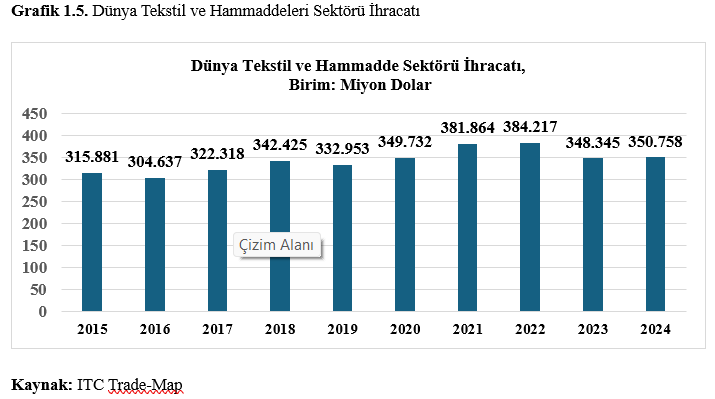

A detailed examination of recent data reveals that Asia-Pacific countries are leading the development and growth of the textile sector. The primary reasons for Asia-Pacific countries’ prominence in the textile sector during this period include their strong economic development, the emphasis placed on policies aimed at ensuring income equity, the rise of the middle class’s economic power, the development of supply chains for production and final products, proximity to raw materials, and lower production costs compared to developed countries. In addition to Asia-Pacific countries, strong growth in the textile sector is also observed in developed economies such as Spain, Italy, and France (Euromonitor International, 2023). In this context, the values of global textile and raw materials exports between 2015 and 2024 are shown in Chart 1.5

Chart 1.6 illustrates the annual change in global textile and raw material exports between 2015 and 2024. While the export value was $315 billion in 2015, it appears to have gradually increased, reaching $384 billion in 2022, despite a generally fluctuating trend. However, global textile exports experienced a sharp decline after 2022, falling to $350 billion in 2024. The aforementioned decline in demand, disruptions in supply chains, and the global economic recession are among the primary reasons for this decline.

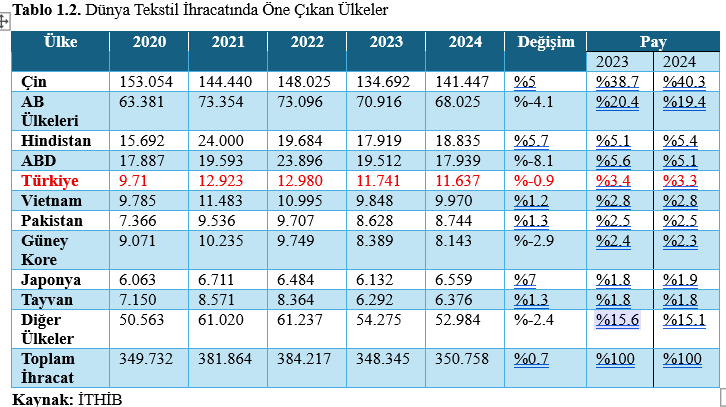

In this context, the leading countries in global textile exports between 2020 and 2024 are shown in Table 1.2.

An examination of the table reveals that the People’s Republic of China, the largest producer and exporter in the textile sector, maintains this position thanks to its low production costs, government incentives, skilled employment, developed supply network, and high production volume. China’s export revenues have been steadily increasing over the years. Consequently, China is the largest textile exporter with a market share of approximately 40%.

The EU-27 region ranks second in world trade, behind China. EU countries are particularly notable for their production methods based on quality and sustainability. Export revenues of European Union (EU) countries have also increased over the years, with EU countries holding a total market share of 20%. In this context, EU countries prioritize ensuring that textile and ready-to-wear products meet specific standards and develop strategies that prioritize environmental responsibility through sustainable production approaches. Furthermore, Europe’s advanced logistics infrastructure and integrated supply chain are among the key factors that put EU countries ahead in this field.

India, on the other hand, has followed a fluctuating trend in terms of export revenues, ranking third with a 5.4% market share. Its relatively lower production costs compared to other countries and its ability to fulfill large-scale orders on time differentiate it positively from other countries. Vietnam ranks fourth in the global textile and apparel sector. Its low production costs and increased government incentives have recently made it a competitor to China. Furthermore, the free trade agreements signed with the US and the EU have played a significant role in Vietnam’s rapid growth in the textile sector. Overall, Asia accounts for 70.6% of global textile exports (World Trade Organization 2025).

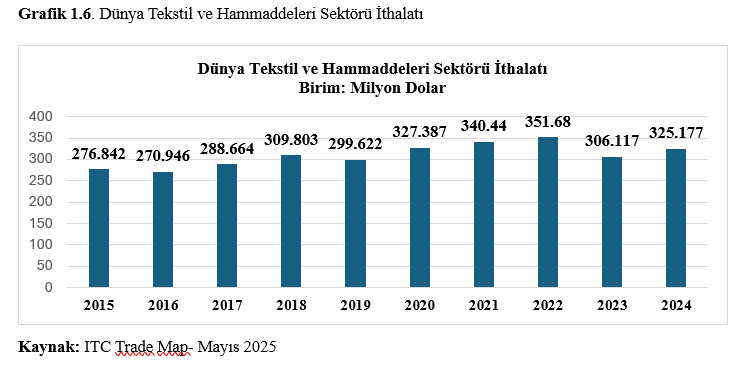

Total export data, which includes information on sectoral supply capacity within the scope of global textile and raw material exports, may be insufficient to provide a comprehensive explanation of global trade. For a more robust analysis, import data from the same period should also be examined. This allows for a clearer picture of the global demand structure, regional interdependencies, and the direction of trade, enabling more robust results. In this context, global textile and raw materials sector import data for the period 2015-2024 is shown in Chart 1.6. Analysis of import data provides a detailed analysis of the changing expectations of consumers and the supply-demand balance in the global textile sector.

An analysis of Chart 1.6 reveals that global textile and raw materials imports stood at $275 billion in 2015, followed a fluctuating but increasing trend over the years, reaching a peak of $351 billion in 2022. After this period, a relatively decreasing trend is observed in 2023 and 2024. This decline can be explained by various factors, including the decline in global demand and the rise in production costs.

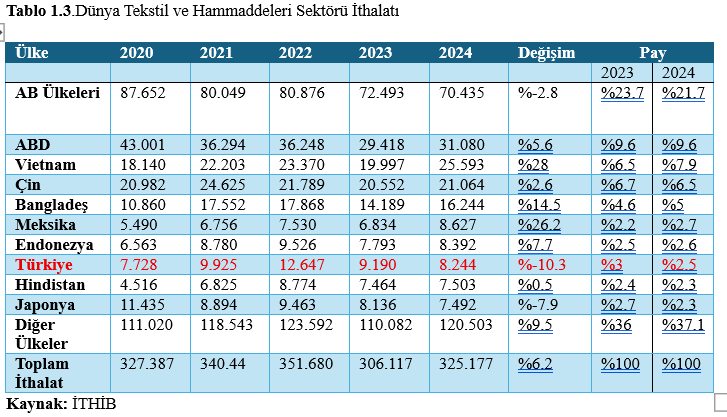

The leading countries in global textile and raw materials imports between 2020 and 2024 are shown in Table 1.3.

An examination of Table 1.3 reveals that EU countries are the largest importers in the global textile sector, with a share of approximately 22%. However, global imports from EU countries are steadily declining, with a 2.8% decrease compared to the previous year, reaching $70 billion in 2024. The US ranks second in global textile imports with approximately $31 billion and a 10% share. Vietnam follows with approximately $26 billion in imports and an 8% share. Turkey ranks 8th in global textile imports, accounting for approximately 2.5%.

5. Risk and Uncertainty Dynamics in Textiles

Recently, the world economy has experienced various socio-economic crises that have had a global impact and led to a decrease in GDP. [The World Health Organization (WHO) declared Covid-19 a global pandemic on March 11, 2020. With the Covid-19 pandemic, almost all countries have implemented mandatory quarantine. This has led to the cessation of production worldwide, a contraction in international trade, a slowdown in supply processes, and negatively impacted employment, except for basic needs (Sülkü et al., 2021:349).] Risk management is defined as the process of systematically identifying uncertainties that may arise in the policies implemented by institutions and organizations in line with their objectives, and also executing strategic policies to eliminate these uncertainties and maximize benefits (Lavopa and Donnelly, 2023). The negative impact of global crises on the production and sustainability of firms and companies has once again highlighted the importance of risk management in this period (Di Giulio et al., 2023; Pathak, 2022).

Turkey’s strategic geographical location, the unique dynamics of its economy, and the multifaceted repercussions of global crises have made risk management a vital element for the textile sector. In this context, risk management is critical for companies to anticipate a wide range of risks, from financial to production and demand-related risks, and to implement appropriate measures in a timely manner, maintaining their competitiveness.

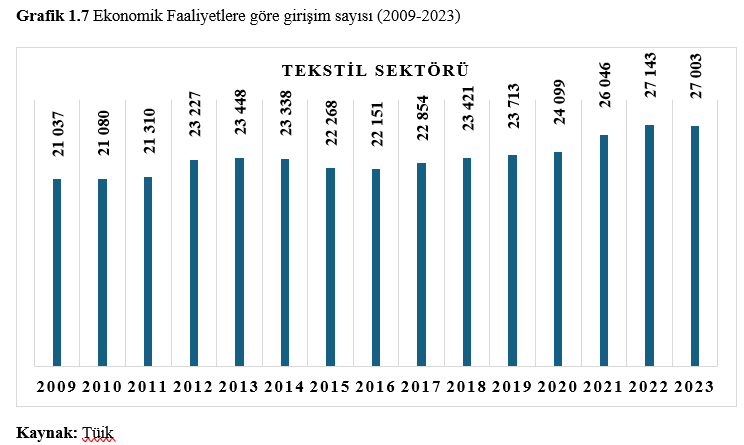

In the Turkish economy, the continuous increase in general prices, extreme volatility in exchange rates, increases in energy and raw material costs, decreases in external demand, and supply chain disruptions, which arise due to the economic climate and particularly affect the textile sector through macroeconomic variables, put pressure on companies during the production process and lead to a reduction in production capacity (CBRT 2022). These macroeconomic risks not only impact production capacity but also directly impact the number of producers in the sector. In this context, Chart 1.7 shows the number of enterprises operating in the textile sector between 2009 and 2023.

An examination of the graph reveals that the number of entrepreneurs in the textile sector has fluctuated over the years. These fluctuations are significant in demonstrating the impact of entrepreneurial activities in the textile sector in a climate characterized by risk and uncertainty. While an increase was observed in 2021-2022 compared to previous years, a decrease was observed again in the following year. The increase in the number of entrepreneurs, particularly in the period after 2020, is significant in demonstrating the sector’s resilience to crises. However, this resilience is directly related to exchange rate volatility, the magnitude of the pass-through effect, cost pressure, and fluctuations in external demand. Therefore, it is concluded that uncertainties in these factors, which can lead to an increase in the cost of capital, influence investment decisions.

In the Turkish economy, changes in exchange rates have direct and indirect effects on production, along with the pass-through effect. The appreciation of exchange rates against the domestic currency increases the costs of imported intermediate goods and equipment during the production process, leading to higher production costs. At the same time, rising exchange rates increase the prices of imported finished goods, putting pressure on overall price levels (Damar; 2010, 10). This situation leads to increased production costs in the textile sector, which relies heavily on imported intermediate goods and equipment, thus negatively impacting the sector’s competitiveness.

Figure 1.4 Annual Exchange Rate Changes 2010-2024 Source: TCMB EVDS

An examination of the graph reveals that exchange rates increased after 2016 and accelerated in 2021. Exchange rates provide critical information for the textile sector, which relies heavily on import substitution production. Sudden increases in exchange rates lead to increased costs, decreased profitability, and the postponement of investment decisions. Anticipating similar financial risks exposes companies to capital losses, cash flow disruptions, and difficulties repaying debt. Therefore, in such periods of increased exchange rate volatility and the impact of the transition, the need to use financial derivatives increases. Therefore, it is crucial to structure liquidity management in conjunction with exchange rate risk and develop strategic plans to support the sustainability of companies in response to potential exchange rate volatility.

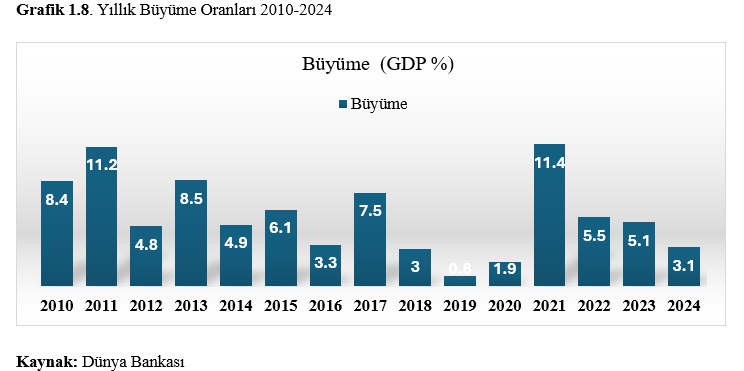

The textile sector, which constitutes a significant portion of GDP at the core of the Turkish economy, constitutes a source of potential growth. Declining domestic demand, in particular, leads to a decline in growth rates, which in turn leads to a decline in production capacity in the textile sector. This decrease in production capacity reduces competitiveness. Under these circumstances, to maintain their competitiveness, companies in the textile sector must adopt a more flexible production model to withstand sudden economic shocks. This is only possible by integrating risk management into production, procurement, and financing processes. Chart 1.8 shows the growth rates of the Turkish economy between 2010 and 2024.

An examination of Türkiye’s growth rates after 2010 reveals a fluctuating trend. These fluctuations, which explain the unstable economic situation, create demand uncertainty, influence investment decisions, complicate access to financing, and directly impact production trends. Therefore, this situation poses significant risks for textile companies, which are labor-intensive and highly sensitive to domestic demand, and are typically SMEs. In this context, to prevent the vulnerabilities caused by fluctuations in growth, determining the appropriate liquidity method, maintaining flexible supply chains, accurate demand forecasting, and appropriate production planning are crucial for the future of companies. Furthermore, to maintain a competitive advantage during periods of slowing growth, increasing export orientation, developing strategic plans to find new markets, and establishing cost-optimized policies are also crucial.

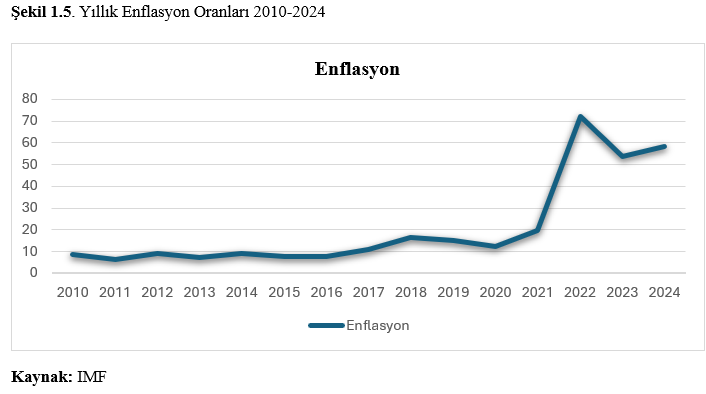

The constant increase in general price levels negatively impacts both production supply (including input costs such as labor, logistics, raw materials, and energy) and consumption demand due to the negative impact on consumer purchasing power. In this context, Changes in inflation in the Turkish economy between 2010 and 2024 are shown in Figure 1.5.

An examination of Chart 1.5 reveals that inflation rates increased after 2016 and accelerated after 2021. During periods of rapid inflation, changing costs make it difficult to price accurately. This negatively impacts companies’ competitiveness. These pricing difficulties also lead to uncertainties in raw material supply. This situation, which disrupts production planning, disrupts the supply chain. Inflation-related cost increases are reflected in the price of final goods, directly impacting consumption demand. Increased risks and uncertainties in inflationary cycles often lead to postponement of investment decisions. In this process, using inflation-indexed contracts is critical to the profitability and sustainability of companies in the textile sector from a risk management perspective. Furthermore, implementing hedging strategies for input costs to reduce the impact of inflation and keep costs under control, improving supply chains, and developing flexible pricing and cost monitoring systems are crucial.

6. Sustainability

The continuous growth of the world’s population and the rise in living standards due to technological advancements have led to increased consumption demand in the textile sector (Eser et al. 2016). Total consumption of textile products exceeded 114 million tons in 2024 (ICAC, World Textile Fiber Demand 2024). Furthermore, the total global consumption of textile products is around 92 million tons annually, and this waste volume is increasing annually (Business Waste). Despite this increase, only 12% of manufactured products can be recycled (Business Waste). Considering the increasing production volume to meet consumption, the rapid depletion of natural resources, accelerating environmental pollution, and rising disposal costs necessitate strengthening environmental performance and the concept of sustainability in the textile sector.

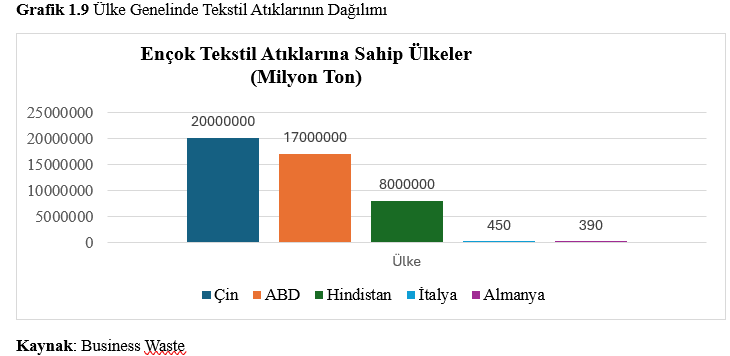

Although textile production doubled from 2002 to 2015, the use of manufactured products decreased by approximately 36% (UN Environment Program). The high use of chemicals, along with the high consumption of raw materials such as water and energy in the production process, leads to the rapid depletion of natural resources and the serious pollution of these resources. The widespread incineration of waste products used in production also increases greenhouse gas emissions (Ellen MacArthur Foundation, 2023). Considering all these impacts together, sustainable raw material use, circular production models, and recycling are global imperatives for the global ecosystem. Therefore, international institutions and organizations are turning to regulations for sustainability. Chart 1.9 shows the amount of textile waste generated nationwide.

An examination of Chart 1.9 reveals that China and the US are the countries that produce the most textile waste each year. These countries are followed by India, Italy, and Germany. Approximately 57% of the products produced each year end up in the trash at the end of the same year, while approximately 25% are incinerated (Business Waste).

Approximately 60% of the textile industry’s products are made from fossil fuel-based fabrics, namely plastic. Furthermore, cotton production consumes an average of 24 million tons of cotton and 93 billion cubic meters of water each year. Furthermore, polyester production requires an average of 70 million barrels of oil each year. The textile industry contributes 9% of global ocean pollution. The textile industry is responsible for 10% of CO2 emissions and is estimated to be responsible for 1.24 billion tons of carbon dioxide emissions globally by 2030 (Business Waste).

Conclusion and Recommendations

Historically, the textile sector has been one of the most important industries in both the global and Turkish economies. The textile sector, which stands out with its employment and export potential within the Turkish economy, has been a driving force of growth and development since the early days of the Republic. While the Turkish economy’s opening to the outside world in the 1980s accelerated its industrialization process, its import-based production system directly affected it by cost-increasing factors such as inflationary pressures and exchange rate fluctuations, which, in turn, led to the restructuring of global supply chains and threatened the sector’s sustainability.

In particular, the supply-demand imbalances observed after the Covid-19 pandemic and the resulting climate of insecurity have led to increased risks and uncertainties, thus negatively impacting markets. This economic climate, which impacted financial markets, has led to increased production costs and the postponement of investment decisions. Furthermore, the need for import-dependent raw materials and technological transformation has increased. This, in turn, has led to a decline in global competitiveness. This transformation in the textile sector has once again highlighted the importance of structural reforms.

In this context, for the Turkish textile sector to maintain its global competitiveness and ensure its current sustainability, investments in areas such as technical textiles and smart textiles in production and a shift towards high-value-added products are among the key strategic steps. Similarly, emphasis should be placed on increasing the use of digital technology in production processes through digitalization and automation, based on efficiency-focused production models. Furthermore, pursuing policies that increase energy and raw material diversity is critical to the sustainability of the sector. To this end, policies that reduce the textile sector’s dependence on energy and raw materials and encourage domestic production should be accelerated.

Given Turkey’s economic structure, high inflation expectations, exchange rate volatility, and changes in consumption demand highlight the importance of risk management strategies in the textile sector. In this context, the use of financial protection instruments that will help companies control their risks should be expanded. To this end, new market search and export strategies should be determined in line with the current economic climate, and new export opportunities should be created in various destinations based on cost-benefit analysis.

Generally speaking, Turkey is a country with a long history and high production potential in the textile sector. However, to ensure the sustainability of this high production potential, policies aligned with current requirements at both the micro and macro levels must be implemented, as well as strong and resilient policies to counter potential economic challenges.

SOURCE

Aras, G. (2006). Avrupa Birliği ve Dünya Pazarlarına Uyum Açısından Türk Tekstil ve Konfeksiyon Sektörünün Rekabet Yeteneği. Mart Matbaası, İstanbul, s. 59.

Arslan, K. (2008). Küresel Rekabet Baskısı Altında Tekstil ve Hazır Giyim Sektörünün Dönüşüm Stratejileri ve Yeni Yol Haritası. MÜSİAD Araştırma Raporlar, 57, İstanbul. 23-98.

Aydoğdu, G. (2012). Hazır Giyim ve Konfeksiyon Araştırma Raporu. Çukurova Kalkınma Ajansı, 5-29.

Bayraktar N. ve Seker A. (2022). ‘The Power Of Turkey In Textile Export and The Dimension Of Competition With China’ /Pressacademia.2022.1577 PAP- GBRC-V.15-(9),54-58.

Beriş E.H. (2008). ‘‘Türkiye’de 1980 Sonrası Devlet Sermaye İlişkileri ve Parçalı Burjuvazinin Oluşumu’’, Ekonomik Yaklaşım, 19 (69), 33-45.

Bulut N.G. 82024) “Türkiye’de Tekstil Sanayiine Tarihsel Bir Bakış,” Türk Tarih Kurumu.

Damar O. (2010). Türkiye’de Döviz Kurundan Fiyatlara Geçiş Etkisinin İncelenmesi, (Uzmanlık Yeterlilik Tezi). Türkiye Cumhuriyet Merkez Bankası, Ankara.

Demir E. ve Önder K. (2023). ‘Avrupa Birliği’ne Aday Ülkelerin Tekstil ve Konfeksiyon Sektörünün Karşılaştırmalı Rekabet Gücü Analizi: 2010-2020 Dönemi’ , Bucak İşletme Fakültesi Dergisi, 6 (1), 64-86.

Di Giulio, G. M., Mendes, I. M., Campos, F. D. R., & Nunes, J. (2023). Risk governance in the response to global health emergencies: understanding the governance of chaos in Brazil’s handling of the Covid-19 pandemic. Health Policy and Planning, 38(5), 593–608

Ekti, E. (2013). “Tekstil Sektörü Raporu”, Doğu Marmara Kalkınma Ajansı Düzce Yatırım Destek Ofisi, 1-39.

Euromonitor International, (2023), https://www.euromonitor.com/global-overview-of-the-textile-and-leather-products-industry/report

Güleryüz, Ö. (2011). Küresel Gelişmeler Işığında Türkiye’de Tekstil Sektörü ve Geleceği. Tezsiz Yüksek Lisans Bitirme Projesi, T.C. Süleyman Demirel Üniversitesi Sosyal Bilimler Enstitüsü, Isparta

International Cotton Advisory Commite (2024). ‘ World Textile Demand Report’

İstanbul Tekstil ve Konfeksiyon İhracatci Birlikleri (2013). ‘Tekstil Sektörü İhracat Performans Değerlendirmesi 2013 Ocak Mart’,

İstanbul Tekstil ve Hammaddeleri İhracatçılar Birliği (2024). ‘ Dünya Tekstil ve Hammaddeleri Sektörü Dış Ticaret Raporu’ İstanbul

Lavopa, A., & Donnelly, C. (2023). Socioeconomic resilience during the COVID-19 pandemic. The role of industrial capabilities. Structural Change and Economic Dynamics. https://doi.org/10.1016/j.strueco.2023.06.004

Nuñez A. M. vd. (2023). ‘Risk governance in the textile/clothing industry: A case study in medium enterprises’ Dutch Journal of Finance and Management, 6 (2), 1-13.

Owen, R., ve Pamuk, S. (1999). A History of the Middle East Economies in the Twentieth Century. Harvard University Press, Cambridge, 10-30.

Özgür, İ. (2006). Türkiye’de Tekstil ve Konfeksiyon Sektörünün Durumu ve Çıkış Stratejileri. Yayınlanmamış Yüksek Lisans Tezi, Kadir Has Üniversitesi Sosyal Bilimler Enstitüsü, İstanbul.

Özyazgan, V. (2012). Türk tekstil sektörünün sorunlar ve çözümü üzerine bazı düşünceler. Anadolu Bil Meslek Yüksekokulu Dergisi, (25): 70-81.

Saygılı Ş. vd. (2010). ‘Türkiye İmalat Sanayiin İthalat Yapısı’ TCMB, Ankara

Sülkü N.S., Çoşar K. ve Tokatlıoğlu Y. (2021). ‘Covid-19 Süreci: Türkiye Deneyimi’, Sosyoekonomi, 29 (49), 345-372.

Şahbudak E. ve Şahin D. (2016). ‘Tekstil ve Hazır Giyim Sektörünün Dış Ticaret Yapısı: Türkiye ve AB-15 Ülkeleri Örneği’, Kesit Akademisi Dergisi, 2 (4), 125-139.

Şentürk, C., Erdal, Y. ve Türkyılmaz, O. (1976). Türkiye’de pamuklu tekstil sanayinin tarihsel gelişimi ve bugünkü durumu. TMMOB, Makine Mühendisler Odası Tekstil Raporu.

The Ellen Macarthur Fondation (2023). ‘ Annual Impact Report And Consolidated Accounts’

Türkiye Cumhuriyet Merkez Bankası (2022). Yıllık Faaliyet Raporu 2021, Ankara

Türkiye Cumhuriyet Merkez Bankası (2025). İmalat Sanayi Kapasite Kullanım Oranı Raporu, Ankara

Türkiye İhracatçılar Meclisi (2024). ‘İhracat Raporu’

Türkiye Cumhuriyeti Sanayi Genel Müdürlüğü (2022). ‘Tekstil, Hazır Giyim, Deri ve Deri Ürünleri Sektör Raporu’

Türkiye Cumhuriyeti Ticaret Bakanlığı İhracat Genel Müdürlüğü (2022). ‘Tekstil ve Hammaddeleri Sektör Raporu’

Türkiye Cumhuriyeti Sanayi ve Teknoloji Bakanlığı (2021). ‘Tekstil Sektörü Analiz Raporu ve Kılavuzu, TR32 Bölgesi’, Ankara.

Uludağ İhracatçı Birlikleri Genel Sekreterlikleri Ar – Ge Şubesi (2020). ‘Türkiye Tesktil Sektörü ve Bursa, Bursa.

Uyanık, S., and Çelikel, D. C.(2019). ‘ Türk tekstil endüstrisi geneldurumu’, Teknik Bilimler Dergisi, 9(1), 2019, pp. 32-41.

Yıldırım, H. (2023). Türkiye’de Tekstil, Giyim Eşyası ve Deri Sektöründe Kârlılığın Makro ve Mikro Dinamikleri. Fiscaoeconomia Dergisi, 7(1), 789-807.

World Trade Organization (2025). ‘Global Value Chains Sectoral Profiles’ Textiles and Clothing Industry 1.10.

World Trade Organization (2023). ‘World Trade Statistical Review 2023’

Bu gönderi şu adreste de mevcuttur: Türkçe